Whether you run an established business or are thinking about starting one, having an accurate and realistic budget is key to helping you make informed decisions and maintain the direction of your business. To succeed, you should understand and consistently track where every dollar goes. Using a business budget can help business owners understand the state of their finances, but according to a survey by Clutch, only half of small businesses created an official budget.

Creating a business budget may seem tedious and intimidating, but you don’t need to be an expert accountant to make it happen. You know your business best and can use that knowledge to plan accordingly. In this article, we will go over key parts of a basic business budget you need to know, show you how to put them together, and provide examples and resources to get you started.

Why You Need a Business Budget

Creating a budget for your business helps you know how much money is coming in and going out at any given time. It is a detailed plan of what you expect to make and where you will spend your money each month (or year). It gives every dollar a “job” that is in line with your business’s goals, and each month you can go back and compare your plan with what actually happened to see if you’re on track. Plus, it can help you plan ahead for slow seasons and fluctuations to make sure all of your expenses are covered. Creating a budget can help you:

- Maximize efficiency

- Estimate what it will take to become and remain profitable

- Predict slow months and keep you out of debt

- Point out leftover funds that you can reinvest

- Establish a financial plan that helps your business reach its goals

- Take advantage of opportunities

Your budget should look back at past months’ numbers to help you make realistic projections for what your situation will be in the future.

How to Create a Business Budget

If you have an established business, use data from previous months and years to inform your budget. If you’re a startup, you’ll need to do some research on costs you can expect based on your industry so that you can estimate revenue and expenses for your budget. You can create a budget using tools within your business accounting software, or by using a simple spreadsheet or template.

1. Keep your business finances and personal finances separate

It might seem easier to keep track of your personal and business money together, especially if your business is small or if you are a sole proprietor, but it can get really complicated later on. Separating your business and personal finances helps you have a more accurate view of your business’s performance, maximize available benefits during tax season, and reduce your personal liability in case of litigation.

Here’s how to keep your business and personal finances separate:

- Consider incorporating your business as an S Corp, C Corp, or LLC to get a federal tax ID number and register for taxes. This reduces your personal liability and makes it easier during tax time.

- Apply for a business checking account and business credit card. This ensures that all incoming and outgoing money related to your business stays separate from your personal accounts.

- Use separate accounting systems for your business and personal budgets. This makes it clear which income and expenses are personal and which are for business purposes.

2. Look at your revenue

Where does your money come from? How much and how often does it come in? Look back at your records and identify all of your revenue sources. Add them together to figure out how much money comes into your business each month. Looking back over multiple months or years can help you notice patterns, such as seasonal fluctuations.

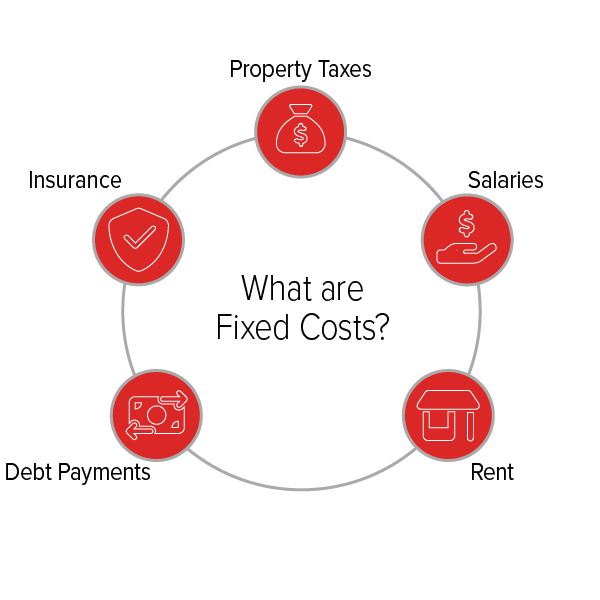

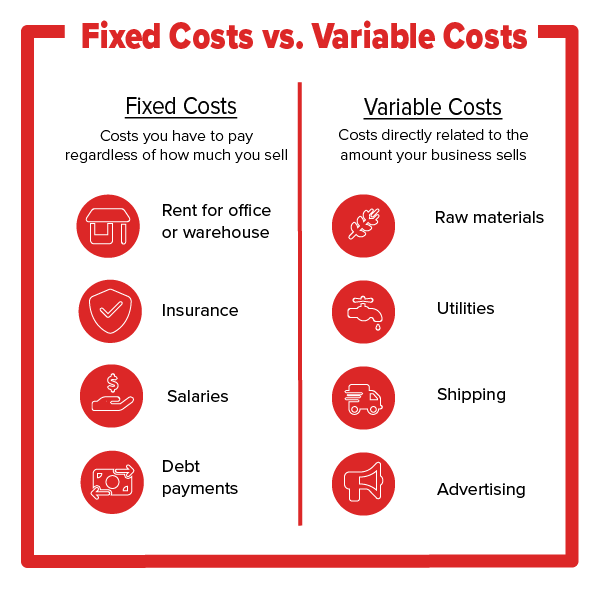

3. Identify your fixed costs

The next step is identifying all of your fixed costs. These are the recurring costs that stay the same no matter how much revenue your business generates. They might occur weekly, monthly, quarterly, yearly, etc. so make sure you look far enough into the past to account for all of them. Some examples of fixed costs are rent, debt payments, employee salaries, property taxes, and insurance premiums.

Your fixed costs are unique to your business, so take your time to make sure you identify all of them. Add each fixed cost together for each month and include them in your budget. If your business is new, research what fixed costs you may have and include a realistic estimate in your budget.

4.Identify your variable costs

While you were reviewing your fixed costs, you probably noticed other expenses that were not consistent. These are called variable costs or expenses because they change depending on production or sales volume. Some examples of variable costs are hourly employee wages, raw materials, utility costs, packaging, shipping, advertising, etc.

Salary costs

The cost of salaries can go in both fixed and variable costs, depending on whose salary it is. Your core team’s salaries are usually a fixed cost because they are consistent. Any wages or salaries for team members related to the production of goods or services are treated as variable costs because they can fluctuate according to production or sales volume. Be sure to account for different salary costs in the correct area of your budget.

One-off costs

One-off costs are expenses that aren’t exactly related to the work your business normally does. These are startup costs like equipment, furniture, and software that typically happen when launching or expanding your business. Including them in your budget is important, so that you have an accurate picture of what it will take to become or remain profitable.

5. Set aside a contingency fund for emergencies

Equipment breakdown, damaged inventory, sudden economic downturns – these are all possibilities that your business needs to prepare for. Things don’t always go according to plan, so it’s best to have extra cash on hand to deal with unexpected expenses, help you recover, and stay on track. You may be tempted to spend extra income on variable expenses, but it is better to create an emergency fund instead. Try to set aside three to six months of your business’s operating expenses to prepare for any unforeseen expenses.

6. Determine your profit

Profit is what you’re left with after deducting your expenses from your revenue. Add up your projected revenue and expenses for each month, then subtract the expenses total from the revenue total. This gives you your profit (also known as net income).

If you get a positive number, that means your business is making a profit. If you get a negative number (a loss), don’t worry too much about it yet. Many small businesses don’t make a profit every month, especially if they are seasonal. For some new businesses, it may take time to see a profit because they must overcome startup expenses and build a customer base. The good news is that you know where your money is going now and can adjust your spending to work towards profitability.

7. Finalize your budget

Now that you’ve tallied up your past revenues and expenses, you have an accurate picture of your business finances. You can use the data to set realistic spending and earning goals for each month, quarter and year and project what your profits will look like in the future. You should regularly compare your projected numbers to your actual numbers to see if your business is meeting your goals and course correct, as necessary.

Templates and Resources

Remember how we said you don’t have to be an accounting expert to make your business budget? Well, you don’t have to be an IT expert either! If you’re not an excel whiz, you can use a business budget template to help you create and stick to your budget. Here are some options to get you started:

- Capterra’s small business budget template is a free Excel workbook where you can create a monthly and annual budget and allows you to compare budgeted vs actual numbers. It has a nice overview sheet and detailed instructions on how to use the template. This one is simple, straightforward, and thorough.

- Google sheets has many budget templates like this Annual Business Budget, department budgets, projection templates, etc. These and others are available in the Template Gallery.

- Template Lab’s small business budget template section has a few different options in Word and Excel formats. These are good for itemizing your expenses.

- If your business already has accounting or bookkeeping software, you likely already have access to budgeting tools within the program that can do some of the heavy lifting for you. Check out the features and templates to see if you can work with what you’ve already got.

Get Started On Your Small Business Budget Today

Whether you’re new to business ownership or even if this isn’t your first rodeo, having a business budget is key to the success and growth of your business. You’ll have a clear picture of how your business is performing, which can help you make informed financial decisions and prepare for the future.Tags: business banking, deposits, savings